Financial affiliate programs can sound a little scary.

But trust us — you don’t need to be a certified public accountant or a financial adviser to make money in the personal finance niche.

You just need to find the best financial affiliate programs, direct your audience toward them, and let the big banks, credit card companies, and loan providers close the deal.

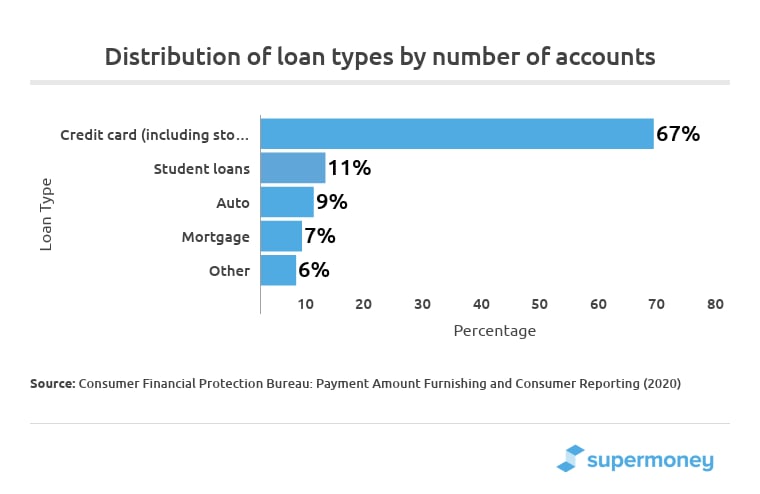

And it’s definitely a good time to start promoting finance affiliate programs. After all, credit cards are by far the most popular type of loan in the US, according to SuperMoney:

More than 191 million Americans have credit cards, with the average card holder having at least 2.7 cards, while average household credit card debt stands at $5,315.

And that’s just a quick snapshot of the opportunity that exists around credit cards. Add in savings and checking accounts, loans, credit scores, and much more. It should be clear that the financial industry is a potential gold mine for affiliate marketers.

Financial Affiliate Programs

- USAA Credit Cards

- BBVA Banks

- LifeLock

- Lending Tree

- Barclays US Online Savings

- CIT Bank

- Ally Invest

- Peer Street

- M1 Finance

- Truebill

- Acorns

- Personal Capital

- Credit Sesame

- Credit Karma

- Coinbase

- Robinhood

- Farther Finance

- Experian

- Binance

- eToro

- WealthSimple

- Wise

- YNAB

- TransUnion

- Questrade

- Remitly

- TransferGo

USAA Credit Cards

The first thing about USAA Credit Cards is they cater to a very specific niche within a niche — financial products for active or retired military members.

The other thing we noticed is that they offer a full range of financial products, from auto and home insurance, to credit cards, checking accounts and auto loans.

They also offer mortgages, health insurance, and even retirement and investment plans.

Granted, some of their products are offered as part of a partnership with another provider, but it still means all the financial needs of a military family can be found under one roof.

Affiliates make $25 per lead, which is on the low side of things for financial services programs.

But USAA generates a lot of revenue for their affiliates, and you have a potential market of 1.3 million active members, and about 21.8 million retired veterans.

So those numbers give you a lot of scope to work with.

URL: USAA Credit Cards affiliate program

Commission rate: $25 per lead

Cookie duration: 30 days

BBVA Banks

You might not be instantly familiar with the BBVA brand, but they’ve been in business since 1964.

They’ve also changed their name a few times over the years, from Central Bank, to Compass, then to Compass Bancshares before they became Compass BBVA (Banco Bilbao Vizcaya Argentaria) and then finally just BBVA.

As you’d expect from a bank, they provide their US customers with checking and savings accounts, personal and business loans, mortgages, credit cards, and a range of investment solutions.

Now for the really interesting bit- they pay $85 for every qualified lead you send their way. And as you can see in the above screenshot they have an EPC of $436.13.

Also bear in mind that if you send enough pre-qualified traffic to a program like this, there’s nothing stopping you from negotiating a separate commission rate later on.

And the nice thing about a program like this is you promote to almost any audience — from mom bloggers to home decor sites, or even just people learning about personal finances.

URL: BBVA USA affiliate program

Commission rate: $85 per lead

Cookie duration: TBC

LifeLock

LifeLock exists because identity theft is way, way more common than people think.

The average victim winds up losing at least $1,343, which is bad enough.

But the overall financial cost of these crimes has been $107 billion since 2011.

The best way to deal with identity theft is to prevent it, and that’s where LifeLock comes into the picture.

They monitor your accounts for unusual activity such as address changes or changes in your credit file, and even if your personal data is being sold on the dark web.

Then again, many businesses don’t report data breaches for up to 60 days after the incident occurs.

This means there’s a potentially limitless market for what LifeLock offers.

As you can see, protecting people against cybercrime can be very profitable too, up to $110 commission per sale.

LifeLock has also been around since 2006, so their product hits the mark with a wide audience.

They offer varying membership levels, with even their basic plan offering up to $25,000 reimbursement for stolen funds if you become a victim of identity theft.

Do you know what sound we hear?

Ka-ching, commissions.

URL: LifeLock affiliate program

Commission rate: Up to $110 per sale

Cookie duration: 30 days

Lending Tree

We already featured Lending Tree in our article on the best debt settlement affiliate programs, but it deserves a mention here too.

No, we’re not being lazy — we just want to make sure we’re exposing prospective affiliates to the best programs for their niche.

First things first, Lending Tree is a price comparison site featuring home loans, personal loans, credit cards, and insurance products.

People love using these sites even though they could go directly to the lender themselves.

And based on their EPC we’re pretty certain that Lending Tree has tapped into that market in a meaningful way.

If you have a blog that could directly or tangentially promote their products, Lending Tree is worth adding to your affiliate program portfolio.

URL: Lending Tree affiliate program

Commission rate: Up to $70 per lead

Cookie duration: 14 days

Barclays US Online Savings

Barclays and their Barclay Card have been a household name in personal and business finance in the UK for literally hundreds of years.

Since 1690 they’ve grown to a banking empire with 48 million customers around the globe, including the United States.

This particular affiliate program revolves around their online-only US savings account service, aimed at people who already have another bank account but want to make the most of the interest rates offered by Barclays.

If you’ve paid attention so far you’re probably staring at their EPC of $906.78, which is staggeringly high.

We’re going to pre-empt your question about their commission rate versus their absolutely massive EPC by saying we can only assume that the information we found on Commission Junction is incorrect. We’re looking for clarification on this as we speak.

Each affiliate would need to refer hundreds of loan applicants every single month to explain an EPC of almost $1,000.

But, as they say, numbers don’t lie, so Barclays US Online Savings affiliates are making a lot of money promoting their service.

URL: Barclays US Online Savings affiliate program

Commission rate: $2 per sale

Cookie duration: 45 days

CIT Bank

CIT Bank has been around since 1908, when it first opened its doors as a financier of local businesses in St. Louis, Missouri.

During the preceding decades, where this bank survived two global recessions and numerous global conflicts, it has gone from strength to strength.

They have also diversified the type of finance products on offer to include a range of personal savings and CD products, as well as mortgages.

Their savings products offer long-term, high-interest accounts, including no-penalty CDs.

CIT also offers affiliates $100 for every qualified lead they send their way, which is extremely generous when compared to most affiliate offers, including other bank affiliate programs.

Promoting financial offers like CIT will probably take more work on your part, but the payouts are more than worth it.

Even if it takes you twice the effort it does to earn a $10 commission, you’re still making 10x as much for 2x the effort.

You’ll never find an employer willing to pay at that scale.

URL: C.I.T Bank affiliate program

Commission rate: $100 per lead

Cookie duration: 30 days

Ally Invest

Ally offers a whole range of financial products, including online savings, investment programs, in addition to their home and auto loans.

But their affiliate program focuses on the investment side of the business, specifically trading in stocks.

Investors can choose between self-directed trading if you’re already an experienced trader, or a managed portfolio for anyone who prefers a more hands-free approach to making money from trades.

So if you’ve always fancied yourself as a bit of a Warren Buffet, you’ve found the perfect program for you.

Well, it’s probably also perfect for you because of the $900+ EPC and up to $50 commission per lead.

Promoting a program of this type usually requires access to a more niche audience, specifically those with disposable income and who are interested in day trading.

But with that being said, Ally is making their affiliates an awful lot of money, so finding or creating that niche audience is well worth the effort.

URL: Ally Invest affiliate program

Commission rate: $25 – $50 per lead

Cookie duration: 45 days

Peer Street

Founded by ex-Googlers, Peer Street is a real estate investment company with a difference.

That difference is that you can start your investment portfolio with as little as $1,000.

Think of Peer Street as a crowd-funded real estate investment platform, linking old-school methodologies with the latest advances in machine learning.

The reality is that money left in savings accounts will earn maybe 3% per year. You can make maybe 10% per year from a managed stock portfolio.

But Peer Street routinely achieves double-digit returns on the type of investment that never goes out of style – real estate.

We like this program because it’s different, and different stands out when it comes to promoting affiliate offers.

$30 per lead is also pretty generous considering their entry-level investment is just $1,000, and their EPC is equally healthy.

Peer Street is one of those companies that will either corner the market or vanish without a trace, but we predict they’ll make a bigger dent than people expect.

URL: Peer Street affiliate program

Commission rate: $30 per lead

Cookie duration: 45 days

M1 Finance

M1 describes itself as a “finance super app”. In layman’s terms, it allows users to invest, borrow, and spend within a single, easy-to-use platform.

You can use it to make flexible, customizable, and automated investments; borrow against those investments at rates of 2% – 3.5% without extra paperwork; and spend their hard-earned cash through digital banking.

It’s clearly proving popular, because hundreds of thousands of investors are using the platform, and the app has racked up more than 35,000 five-star reviews on the Apple and Google Play stores. Not only that, but it’s been named Yahoo’s number one free trading platform.

Which brings us to M1’s affiliate program. Sign up through the Impact affiliate network and earn a healthy $100 each time an account you refer reaches $1,000 in funding.

The cookie window lasts only 30 days, but you’ll earn your commission as long as your referrals hit $1,000 within 400 days.

URL: M1 Finance affiliate program

Commission rate: $100

Cookie duration: 30 days

Truebill

Truebill is a money management app designed to help users stay on top of their spending, manage their subscriptions, and reduce their bill payments.

It’s got some pretty impressive functionality. For instance, the app can cancel unwanted subscriptions on your behalf and even has experts on hand to negotiate better rates for you.

While you can download the app and use some of the features free of charge, other services cost money. Accessing the premium features— such as the “Cancellations Concierge” I described above— costs from $3 – $12 a month, or $36 – $48 a year.

Unlike some personal finance affiliate programs, you don’t actually need to drive a premium sale to earn a commission here.

Instead, Truebill pays out $10 every time your referrals download the app and link it to their checking account or credit card.

URL: Truebill affiliate program

Commission rate: $10 per linked account

Cookie duration: 30 days

Acorns

Acorns is a micro-investing platform that makes it easy for members to automatically set aside their spare change or a small chunk of cash from each paycheck and use it to build a future nest egg.

Users get access to smart investment portfolios designed by experts that are automatically adjusted as their savings grow. Presumably it works pretty well, because more than eight million people have signed up so far.

The brand’s audience skews younger than most financial brands, with an average age of 24 – 35. So if your site targets a predominantly Millennial demographic, this is one of the best financial affiliate programs you can choose.

Acorns pays a $10 commission for every qualified lead you send its way— so again, you don’t need to drive sales to earn money through this affiliate program.

URL: Acorns affiliate program

Commission rate: $10 per lead

Cookie duration: 30 days

Personal Capital

Personal Capital says its goal is to provide “a better, more logical and personal way to invest and manage your money”.

To achieve that, it offers users a bunch of personal finance-related tools, including a net worth calculator, a retirement planner, and a fee analyzer designed to unearth hidden fees in mutual fund, investing, and retirement accounts.

It’s evidently good at what it does, because more than three million people use its various features, with more than $20 billion worth of assets under management as of July 2021.

You can get your hands on some of that cash through the Personal Capital affiliate program.

The affiliate program pays an impressive $100 for each qualified lead, and the company claims its top affiliates earn up to $50,000 monthly.

URL: Personal Capital affiliate program

Commission rate: $100 per qualified lead

Cookie duration: 30 days

Credit Sesame

Credit Sesame is a membership site that gives its users free credit reports and provides advice on how to improve it.

As well as this, it offers a fee-free debit account that pays members up to $100 every 30 days as their credit score improves. Get paid for building strong credit? Sounds too good to be true!

Not only that, but Credit Sesame also gives its members $1 million in free identity theft insurance, so if the worst happens and their identity gets stolen, they’ve got protection to fall back on.

Credit Sesame sounds like a pretty easy sell for affiliate marketers in the financial niche with all of those features available free of charge.

Best of all, its affiliate program pays commissions of $9 per registered user, whether or not those users actually go on to spend any money with Credit Sesame.

URL: Credit Sesame affiliate program

Commission rate: $9 per registered user

Cookie duration: 30 days

Credit Karma

Credit Karma is a similar tool to Credit Sesame— firstly, because its name starts with the word “credit”, and secondly, it offers free credit scores.

That said, it’s arguably a bigger and better-known brand than Credit Sesame, with more than 100 million members using the app. In turn, that theoretically makes it easier for affiliates to promote.

However (sorry, there’s always a “however”), it’s not quite so simple to earn a commission here than through a lot of other financial affiliate programs. Why? Because Credit Karma only pays out on online mortgage submissions.

That’s a pretty major financial decision, which means a longer conversion funnel, and it also rules out any members of your audience who don’t own a home.

URL: Credit Karma affiliate program

Commission rate: $12 per online mortgage submission

Cookie duration: 30 days

Coinbase

Unless you’ve been hiding under a rock for several years, you’ll know cryptocurrency has been attracting a whole lot of attention in the financial industry (and beyond).

In fact, 21 million Americans— or about 14% of the population— own cryptocurrency right now, while around 13% plan to purchase crypto in the next year.

This brings us to Coinbase, which positions itself as the “easiest place to buy and sell cryptocurrency”.

The platform offers all the major currencies, from Bitcoin and Etherium to Tether and Dogecoin.

It works in over 100 countries, has more than 56 million verified users, and has a quarterly traded volume of $335 billion.

All of which means there’s plenty of money to be made here. Sign up for the Coinbase affiliate program and you’ll earn 50% of your referrals’ trading fees for the first three months.

URL: Coinbase affiliate program

Commission rate: 50% of trading fees for three months

Cookie length: 30 days

Check out our in-depth Coinbase affiliate program review.

Robinhood

Robinhood is a commission-free trading platform designed to make it easy for anyone to invest in stocks and shares. If its name sounds familiar, that’s likely because it was at the center of early 2021’s GameStop trading frenzy.

It’s hugely popular, with the number of funded accounts— that is, those with bank accounts linked to them— climbing to 18 million as of March this year, up from just over seven million a year earlier.

Unfortunately, while there’s definitely a ton of interest in platforms like Robinhood, its terms and conditions don’t stack up too well against the very best financial affiliate programs— $5 per lead is nothing to get too excited about.

However, there’s more to be made from referring funded accounts.

URL: Robinhood affiliate program

Commission rate: $5 per signup, $20 per funded account

Cookie duration: 30 days

Farther Finance

Traditionally, wealth management has only been available to the ultra-rich. That’s hardly surprising— it’s literally got the word “wealth” in it.

But, to adopt a horrendous buzzword, Farther Finance is one of the companies seeking to “democratize” the industry, combining technology and expert advisors to bring wealth management to the masses.

And you can help them do it by signing up to their affiliate program! Like with Robinhood, though, the affiliate terms aren’t the best, with a payout of just $5 for every new email signup you refer. On the flip side, you don’t actually need to drive a sale to earn a commission.

URL: Farther Finance affiliate program

Commission rate: $5 per new email signup

Cookie duration: 30 days

Experian

Experian is a massive player in the world of consumer financial services as one of the so-called “big three” credit score providers, along with Equifax and TransUnion. Consumers in dozens of countries turn to Experian to learn about their credit score and find out how to improve it.

Given the importance that credit plays to our daily lives, there’s clearly a huge need for Experian’s services, making this potentially one of the best affiliate programs in the finance niche.

Still need convincing about the scale of the opportunity? Try this for size: more than 3.1 million Experian members use its credit monitoring products, and the company has delivered more than 20 million online credit reports.

So does Experian offer one of the best financial affiliate programs? Well, it’s actually a bit of a mixed bag.

On one hand, the program— run through CJ Affiliate— pays a $6 commission for referring customers to sign up for a free account.

Commissions range from $7 – $30 for paid products. But on the downside, the 10-day cookie window is the worst of all the financial services affiliate programs we’ve looked at here.

URL: Experian affiliate program

Commission rate: $6 – $30 per order

Cookie duration: 10 days

Binance

Along with Coinbase, Binance is another of the big cryptocurrency trading platforms. It’s the driving force behind more than 1.4 million transactions every single second, and has an average daily volume of $2 billion.

So you won’t be surprised there’s a ton of money to be made here. Paying a lifetime commission of up to 50% on every qualified trade, Binance offers one of the highest-paying financial affiliate programs we’ve seen.

However, it’s worth noting that the Binance affiliate program isn’t open to just anyone. As an affiliate marketer, you’ll need to:

- Have at least 5,000 subscribers on Youtube, Twitter, Facebook, or Instagram

- Run a crypto community with at least 500 members

- Own a website with a user base of 2,000+ people

URL: Binance affiliate program

Commission rate: Up to 50% lifetime commissions

Cookie duration: 90 days

eToro

eToro is an all-in-one trading platform, allowing members to trade stocks and ETFs, cryptocurrencies, and CFDs from a single hub. Just don’t ask me to explain what an ETF or CFD is.

It’s an extremely popular site, with more than 16 million users worldwide, and almost 350 million trades opened on the platform at time of writing.

And it’s easy to see why, with its 50 most-copied traders enjoying an average yearly profit of 83.7% in 2020.

So what about eToro’s affiliate program? Well, it’s pretty damn impressive, paying a CPA of up to $250.

And to help you along the way, you’ll get access to converting promo tools, intuitive tracking systems, and the ongoing support of eToro’s dedicated affiliate managers.

URL: eToro affiliate program

Commission rate: Up to $250

Cookie duration: Lifetime

Wealthsimple

Wealthsimple bills itself as a “smart, simple” investing platform. It provides expert financial advice to help customers set out their key investing goals, identify the right investment accounts, and answer questions on potential risks.

More than 1.5 million people around the world use its investing, saving, and tax products to help them secure long-term financial freedom.

One potential barrier to conversion for services like Wealthsimple is that your audience might already have one or more savings accounts with a different provider.

However, Wealthsimple deals with this by paying their administrative transfer fees, which is a helpful selling point.

Speaking of selling, Wealthsimple affiliates earn $5 – $50 for every funded client they refer, with commissions varying based on the amount those referrals invest.

URL: Wealthsimple affiliate program

Commission rate: $5 – $50 per funded client

Cookie duration: 45 days

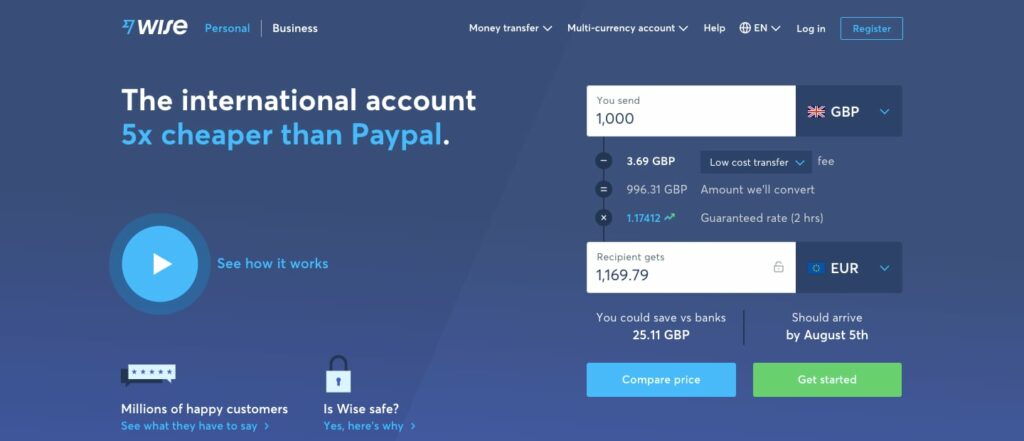

Wise

Wise is an international money transfer service that helps more than 10 million consumers and businesses save money on international currency transactions.

It also does a bunch of other stuff, such as offering a debit card that allows people to spend money in 200 countries without encountering any hidden fees.

With a well-known brand and international reach, there’s plenty of scope for monetization through the Wise affiliate program. Sign up and you can earn a £10 commission for every personal user you refer, or £50 per business customer.

What’s more, while the majority of financial affiliate programs we’ve seen offer the classic 30-day cookie window, Wise offers a lifetime cookie, so you’ll be paid a commission whether your referral signs up in a week, a month, or a year (or even longer).

URL: Wise affiliate program

Commission rate: £10 for personal users, £50 for business customers

Cookie duration: Lifetime

TransUnion

If you were listening (well, reading) closely a little while ago, you’ll recall there are three big credit scoring companies. TransUnion is one of them, along with Experian and Equifax.

Just like the other two, TransUnion allows consumers to view their credit scores and take steps to repair and improve them. It also offers $1 million in identity theft insurance, which is always handy.

While TransUnion has a lot of products and services, its affiliate program is focused on just one of them— credit monitoring.

When someone you refer signs up for its credit monitoring product, you’ll earn a commission, but unfortunately, if they buy a different product, you get nothing.

URL: TransUnion affiliate program

Commission rate: Unlisted

Cookie duration: 30 days

Questrade

Questrade is an online brokerage and wealth management company based in Canada. In fact, it’s the country’s fastest growing online brokerage, with more than 200,000 accounts opened annually and $25 billion in assets unders its administration.

It specializes in charging customers low commissions, with wealth management fees starting at just 0.25% (or 0.2% for people investing more than $100,000).

Fortunately, those low commissions don’t apply to Questrade’s affiliate program— quite the opposite in fact.

The company offers a choice of CPA or revenue share models, with the former paying $70 per acquisition, and the latter paying a 7.5% cut.

Not only that, but when you refer new affiliates, you’ll earn $10 or 1.5% of commissions generated for every new account your sub-affiliates refer, depending on your choice of plan.

Think of all that passive income!

URL: Questrade affiliate program

Commission rate: $70 CPA or 7.5% revenue share

Cookie duration: 60 days

Remitly

Similar to Wise, Remitly does international money transfers. Unlike Wise, it’s aimed squarely at immigrant communities the world over, which is reflected in the wealth of receiving options it provides— from bank deposits and mobile money transfer, to cash pickups and even home delivery.

Unsurprisingly, Remitly’s affiliate program is all about persuading users to sign up and send money abroad. As such, it pays a commission only when a first-time transaction has been made— no cash for leads here.

Those commissions vary on the amount of money sent, with payouts ranging from $4 to $20 per first-time transaction.

URL: Remitly affiliate program

Commission rate: $4 – $20 on first-time transactions

Cookie duration: 30 days

TransferGo

Similar to Wise, TransferGo is an internal money transfer service. Based in London, it’s used by 2.5 million customers worldwide to send cash to more than 160 countries.

It prides itself on quality customer service, offering support in nine languages, which has helped the company rack up a 4.8-star “Excellent” rating from over 20,000 reviews on Trustpilot.

That all sounds good, but is this one of our favorite financial affiliate programs?

Possibly. Affiliates earn a base commission of £10 for every new user who uses the platform to transfer money, with higher commissions available for strong performance.

What’s more, unlike a lot of affiliate programs, TransferGo doesn’t force you to spend a ton of time on content creation by offering access to localized banners, videos, and articles.

URL: TransferGo affiliate program

Commission rate: £10+

Cookie duration: 30 days

How to Promote Financial Affiliate Programs

Let’s get one thing straight— financial affiliate programs aren’t a license to print money. The finance niche is extremely competitive.

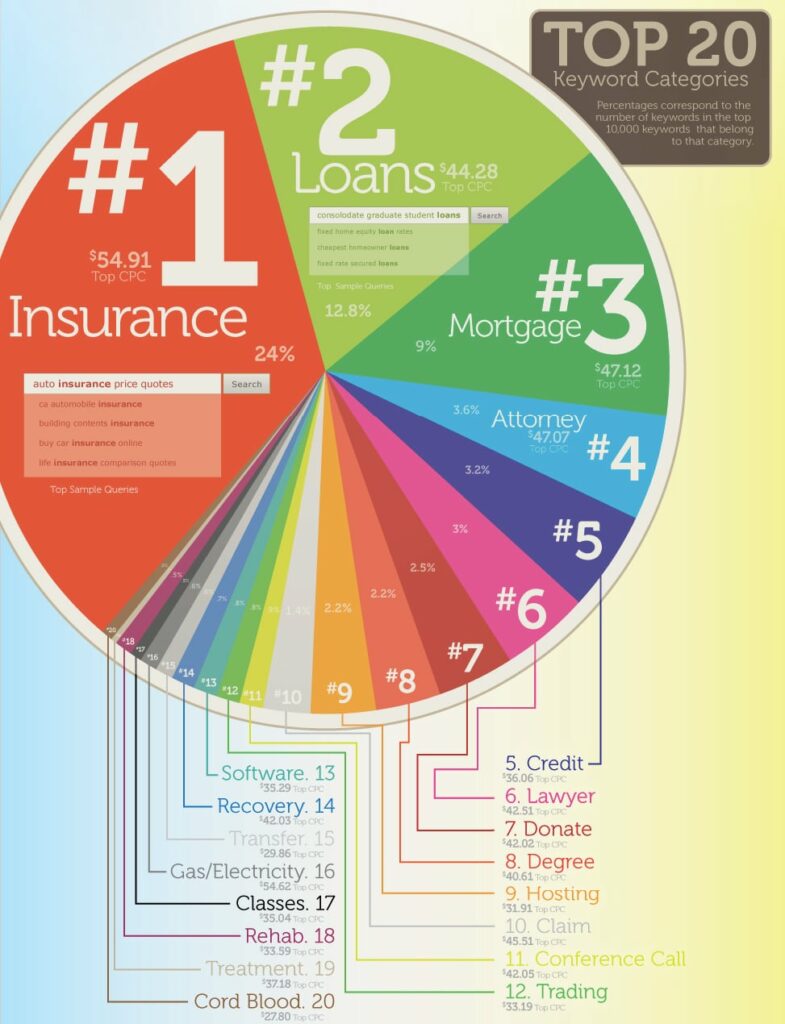

How competitive? Well, to give you an idea, WordStream did some research into the 20 most expensive keyword categories within Google Ads. As you can see, the top three — insurance, loans, and mortgages — are all related to the financial niche:

In other words, expect to have a hard time getting your content to rank in the first place, let alone persuading your audience to click a link and sign up for a loan or credit card.

But that’s not to say it’s impossible. There are definitely some easier, less competitive keywords out there— you just need to know where to find them.

For instance, the term “best credit cards” has an Ahrefs keyword difficulty of 81, making it near-impossible to rank for.

But “best credit cards for young professionals” is much more achievable, with a difficulty score of just 19.

Do your keyword research and you’ll definitely find opportunities that suit your audience.

The Bottom Line

As you can see, there’s a lot more to the finance niche than just payday loans and credit cards.

And let’s take the above example of military loans. Hundreds of low-competition keywords show up in Ahrefs for that niche.

Hundreds, we spent a few minutes investigating in more detail for just one program.

But we get that evaluating niches isn’t easy until you know-how.

This is why we think you might enjoy our free training session on the subject of authority sites.

We give away information that other “experts” charge for – check it out here.

https://www.badadeal.com/affiliate-marketing/27-best-financial-affiliate-programs-to-join-in-2022/?feed_id=1858

Comments

Post a Comment